Soda taxes are still a relatively new phenomenon, as it was only recently that governments were forced to reckon with previously unimaginable rates of obesity and the high costs they incur. The United States is one of the worst offenders in the world, yet so far not a single state has passed its own soda tax.

But individual cities have, and their success in doing so has been heartening for advocates of a crackdown on added sugar. In the face of a massive beverage industry lobby

(which benefits from the scarcity of beverage taxes and, therefore, any accompanying research), municipal governments have pushed through hefty taxes and similar measures designed to stifle the public appetite for sugary drinks.

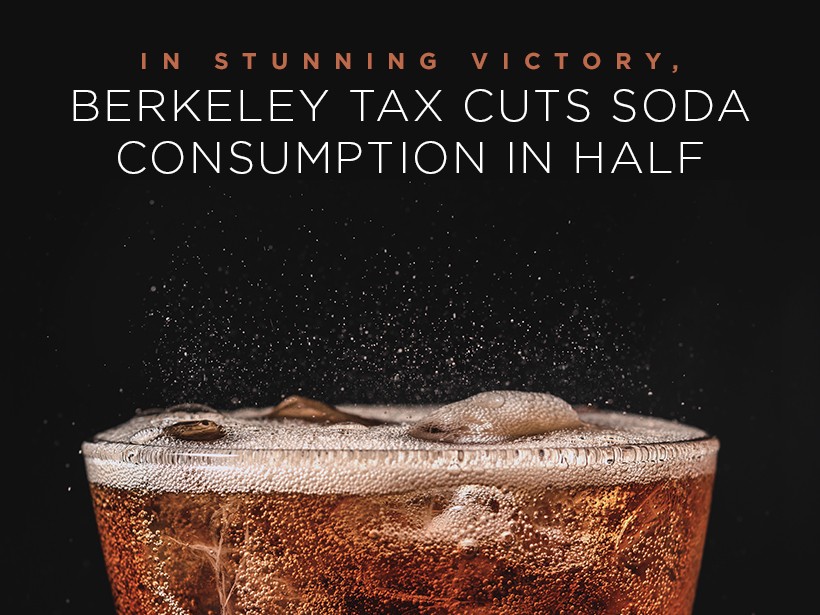

A “major success” for public health

One such city is Berkeley, California, where supporters of a 2014 tax voted it in despite an expensive campaign against it by the beverage industry. Researchers recently began following up on that tax, having given it a few years to settle in, and quickly uncovered some shocking results.

In February, a study found that by 2017 Berkeley residents had cut their soda consumption by an astounding 50 percent, after a 21 percent reduction in just the first year.1 That’s compared to the relatively steady consumption of nearby cities like San Francisco and Oakland, both of which enacted their own soda taxes towards the end of the period being looked at in the study.

“The research certainly suggests that taxes continue to have huge potential as a public health tool,” said Dr. Kristine Madsen, a professor at the Berkeley Food Institute and author of the study. “This is a major success in Berkeley.”

A soda tax working on two levels

A second study, published in April, found that the benefits of the Berkeley tax in deterring consumption might extend beyond the simple increase in the cost of soda. Its authors argue that the very public fight for the tax and against the soda lobby (dubbed “Berkeley versus Big Soda”) and the public vote that ratified it were themselves effective deterrents.2

“The election outcome caused a ten to twenty percent reduction in sales of regular soda beverages before consumers faced higher prices anywhere,” said Scott Kaplan, one of the study’s authors. The study goes so far as to suggest that the media coverage and results of the vote had a greater impact on consumption than the tax itself.3

Whether it’s the taxes themselves or some combination of price increases and media coverage, Berkeley is only the tip of the iceberg when it comes to the remarkable early impact of these new local and national laws. From countries like Mexico, Britain, and India to U.S. cities like Berkeley and Philadelphia, early research on the effects of these taxes shows their potential to have a lasting impact. The big question now is how quickly they will continue to spread in the urgent fight against global obesity.

NUTRITIONAL DISCLAIMER

The content on this website should not be taken as medical advice and you should ALWAYS consult with your doctor before starting any diet or exercise program. We provide nutritional data for our recipes as a courtesy to our readers. We use Total Keto Diet app software to calculate the nutrition and we remove fiber and sugar alcohols, like erythritol, from the total carbohydrate count to get to the net carb count, as they do not affect your blood glucose levels. You should independently calculate nutritional information on your own and not rely on our data. The website or content herein is not intended to cure, prevent, diagnose or treat any disease. This website shall not be liable for adverse reactions or any other outcome resulting from the use of recipes or recommendations on the Website or actions you take as a result. Any action you take is strictly at your own risk.

- California Pushes for Cigarette-Like Warning Labels on Soda - July 1, 2019

- Is a Slowdown in Australia's Sugar Consumption a Sign of More to Come? - June 24, 2019

- Groundbreaking Study Says the Sugar Rush Doesn't Exist - June 12, 2019